Believe it or not, the Government are actually trying to reward you for saving for your retirement.

Are you an Employee, Company Director or Self Employed?

If so, are you aware that you have until the 31st October (10th November if filing through ROS) to reduce your Income Tax paid or payable against your 2015 Assessable Income?.

Income Tax Relief can be claimed by making pension contributions paid in 2016 against 2015 earnings to one of the following:

- Personal pension,

- PRSA or

- Occupational Pension Scheme.

The way you do it is with a top up payment, or an Additional Voluntary Contribution (AVC) which needs to be made by a certain date, 31 October 2016, if you want to claim tax back for the 2015 tax year.

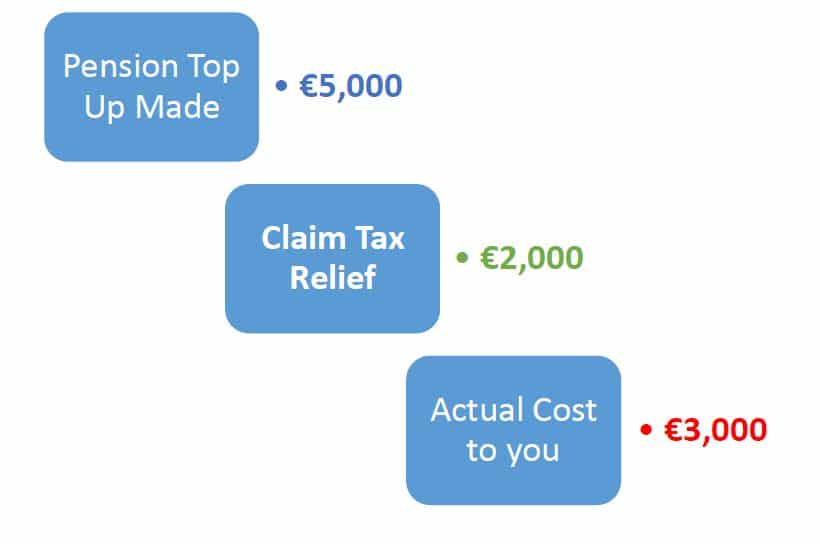

Let’s look at an example, say you are in the marginal tax bracket (paying 40% income tax) and want to top up your pension with an AVC of €5,000:

What does that mean for you?

Your pension savings get the full €5,000 top up, which is invested in your pension pot until you retire. This year, 2016, you get to claim back at your marginal tax rate of 40%.

That’s €2,000 back in your pocket, right now. Which means it only actually cost you €3,000 to top up your pension by €5,000.

A 66.66% return on your pension in one single transaction is much greater than what available today through regular investment.

I have attached an Income Tax Relief calculator here to help you calculate how much you can contribute for tax relief purposes this year, or to target a pension at retirement within the income exemption limits set out.

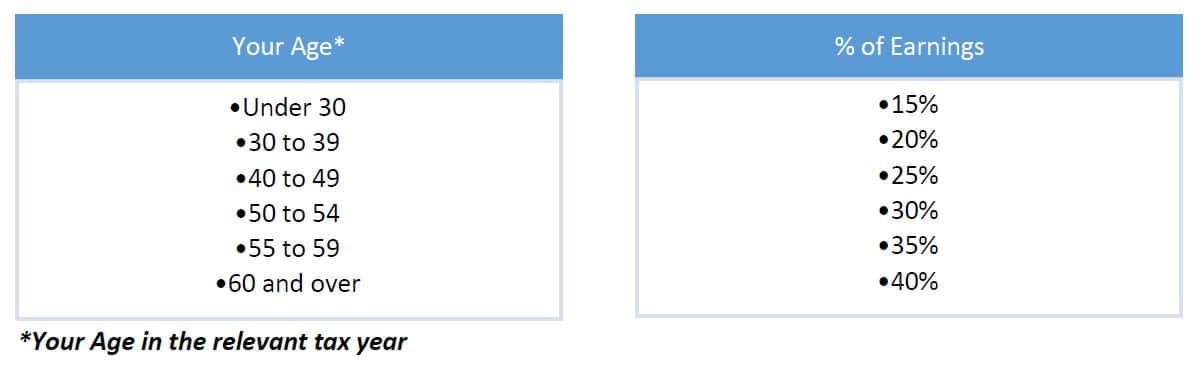

Income tax relief is available on payments up to a certain percentage of your net relevant earnings, subject to an earnings limit of €115,000 per year. The percentage changes depending on your age. You can only claim income tax relief within this limit. Entitlement to income tax relief is not guaranteed.

One area that I feel is being completely underutilised in retirement planning today is where Employees do not avail of the opportunity to claim Income Tax Relief via AVCs or PRSA AVCs on an annual basis.

AVCs or PRSA AVCs paid before 31st October 2016 can be backdated against income tax paid in 2015 provided the individual is still in the same employment.

An employee has until 31st October 2016 to:

- Pay a single premium AVC to their main company pension scheme (if the scheme offers this option), a PRSA AVC or through their existing AVC plan (if they have one), and claim income tax relief for 2015 tax year.

- Send their tax return to Revenue, electing to backdate the pension contribution to 2015 tax year.

If an employee elects to backdate a contribution to a previous tax year, they nee to make sure that relief has not already been given in the current tax year. Where the contribution is paid through payroll under the net pay arrangement, income tax relief is automatic and is given in the current tax year.

PAYE individuals who are required by Revenue to file a Form12 for 2015 can opt to file online using eForm12, in which case they have until 10th November 2016 to pay their pension contribution and submit their tax return.

Limits apply as to how much an Individual can Contribute to a Personal Pension, PRSA, PRSA AVC or AVC?

For contributions paid in 2016 and set against 2015 earnings, an earnings cap of €115,000 applies for tax relief purposes to total contributions to PRSAs, personal pensions and employee / AVC contributions to occupational pension schemes. Your cap is calculated as follows:

*Your Age in the relevant tax year

Note:

- The above limits include any employer contributions to a PRSA

- The earnings limit does not apply to employer contributions to occupational pension schemes

- For occupational pension schemes, the total contributions (employer, employee & AVC) must be within overall Revenue maximum contribution limits

Finally, it is worth highlighting that if an individual pays more than the income tax relief limit into a PRSA or pension plan today, then they can carry forward the unused relief to future tax years and offset it against relevant earnings for those years.

Hopefully as outlined above, there is scope for everyone to claim tax relief in the relevant tax year and reduce the amount paid to the Revenue and the Department of Finance.

It is recommended that you seek financial and retirement planning advice before making an additional contribution to pension in the coming weeks and to seek that advice on the best options’ for your particular circumstances.

At First Choice Financial Services DAC, we offer a wide range of services on retirement and if you would like to discuss your options further, please contact us on 061-317260 or email [email protected]

Jim Wallace

RPA QFA SIA ACCA

Calculator source Irish Life Assurance PLC. www.irishlife.ie